Hunting for the cheapest car insurance Florida has to offer can feel like chasing a ghost, but things are genuinely starting to look up. While the Sunshine State has a reputation for sky-high premiums, getting a handle on why it costs so much is the first real step toward finding a policy that doesn't break the bank.

Why Florida Car Insurance Is So Expensive

If you've ever gotten a car insurance quote in Florida, you’ve probably had a moment of sticker shock and asked, "https://bdischool.com/why-is-my-car-insurance-so-high/". It’s a fair question. The answer isn't a single thing but a perfect storm of factors that makes our insurance market one of the trickiest in the country.

Once you see what's driving the costs, you'll be in a much better position to find a genuinely cheap policy. A few key culprits are behind the state's historically high rates:

- Wild Weather: Florida is a magnet for hurricanes, tropical storms, and flash floods. All that severe weather means a ton of comprehensive claims for water damage and other storm-related messes.

- Crowded Roads: Our major cities—Miami, Orlando, Tampa—are bustling with both residents and millions of tourists year-round. More cars packed onto the roads simply means a higher chance of accidents.

- Lawsuit Central: For a long time, Florida was notorious for auto-related lawsuits and fraudulent claims. This legal environment made it incredibly expensive for insurance companies to operate, and they passed those costs right along to us in the form of higher premiums.

Florida's "No-Fault" System Explained

A huge piece of the puzzle is Florida's "no-fault" insurance system, which requires every driver to carry Personal Injury Protection (PIP). The idea was to speed up the claims process by having your own insurance cover your initial medical bills, no matter who was at fault in an accident.

The Bottom Line: Under Florida's no-fault law, you must have at least $10,000 in PIP and $10,000 in Property Damage Liability (PDL). This is the absolute minimum, and it sets the starting price for any policy in the state.

While the system was meant to help, it unfortunately became a prime target for fraud, which just inflated costs for everyone. To get a better grasp on the mechanics, you can learn more about Personal Injury Protection (PIP) auto insurance and see how it shapes the policies we buy.

Good News: Market Shifts Are Creating New Savings Opportunities

After years of pain, there's finally some light at the end of the tunnel. The market is changing. We saw a dizzying +31.7% average rate hike not long ago, fueled by a post-pandemic surge in traffic and out-of-control litigation.

But then, the state passed major legal reforms to clamp down on fraudulent claims and frivolous lawsuits. The impact was immediate. Florida's personal auto liability loss ratio plummeted to 53.3%, one of the lowest in the nation. In response, major insurers started announcing rate decreases.

Now, the average cost for full coverage is settling around $3,884 annually, with minimum coverage dropping to about $1,056 a year. This shift has created a much more competitive environment, meaning it’s a fantastic time to shop around and use the strategies in this guide to lock in a better rate.

How to Read Your Florida Auto Insurance Quote

Getting an auto insurance quote can feel like you’ve been handed a document in a foreign language. It's just a wall of text filled with acronyms, coverage limits, and prices that don’t immediately make sense.

But here’s the thing: learning to decipher that quote is the single most powerful tool you have for finding genuinely cheap car insurance in Florida. When you know what you’re looking at, you see exactly where your money is going. It puts you in the driver's seat, allowing you to compare apples to apples and avoid paying for coverage you just don't need.

Finding the Core Coverages on Your Quote

Every Florida insurance quote is built around a handful of key coverages. Some are required by law just to be on the road, while others are optional layers of protection. Let's break down the main ones you'll see listed.

- Personal Injury Protection (PIP): This is non-negotiable in Florida. It covers 80% of your initial medical bills and 60% of lost wages, up to a $10,000 limit, no matter who caused the accident.

- Property Damage Liability (PDL): This is also required. It pays for the damage you cause to someone else's property, like their car, a mailbox, or a fence. The state minimum is $10,000.

- Bodily Injury Liability (BIL): Surprisingly, this isn't mandatory to register a car in Florida, but driving without it is a massive financial risk. BIL pays for injuries you cause to other people if you're at fault. Without it, you could be sued personally for their medical bills.

These three are the foundation of your policy. You'll often see them written as a shorthand like "10/20/10." That simply translates to coverage limits of $10,000 in BIL per person, $20,000 in BIL per accident, and $10,000 in PDL. Getting a handle on these basics is a huge first step, and from there you can learn more about how much car insurance costs and what really drives the price up or down.

To help you sort through all the options, here’s a quick breakdown of the most common coverages you’ll encounter on a Florida auto insurance quote.

Florida Car Insurance Coverage Explained

| Coverage Type | What It Covers | Is It Required in Florida? | Who Needs It Most |

|---|---|---|---|

| Personal Injury Protection (PIP) | Your own medical bills and lost wages after an accident, regardless of fault. | Yes, a minimum of $10,000 is required. | Every driver in Florida. |

| Property Damage Liability (PDL) | Damage you cause to another person's property (their car, fence, etc.). | Yes, a minimum of $10,000 is required. | Every driver in Florida. |

| Bodily Injury Liability (BIL) | Medical expenses and lost income for others if you cause an accident. | No, but it's required under the Financial Responsibility Law after certain violations. | All drivers. It's essential financial protection. |

| Uninsured/Underinsured Motorist (UM/UIM) | Your medical bills if you're hit by a driver with no insurance or not enough insurance. | No, but insurers must offer it to you. | All drivers, especially considering how many uninsured motorists are on the road. |

| Collision | Repairs to your own car after an accident you cause or a hit-and-run. | No, but often required by a lender if you have a car loan. | Anyone with a newer or more valuable car they couldn't afford to replace. |

| Comprehensive | Damage to your car from non-collision events like theft, vandalism, fire, or hitting an animal. | No, but often required if you have a car loan. | Drivers who live in high-theft areas or want protection from "acts of God." |

Understanding these different pieces helps you build a policy that fits your actual needs instead of just paying for a pre-packaged deal.

Premiums vs. Deductibles: The Real Cost Trade-Off

Once you get past the list of coverages, two numbers have the biggest impact on your wallet: the premium and the deductible.

Your premium is simply the price you pay for the policy, whether you pay it all at once or in monthly installments. Your deductible is what you have to pay out-of-pocket for a claim on your own vehicle (for Collision or Comprehensive coverage) before the insurance company pays a dime.

Key Insight: These two numbers have an inverse relationship. If you choose a higher deductible, you agree to take on more financial risk yourself after an accident. In return, the insurance company will give you a lower premium.

For instance, bumping your deductible up from $500 to $1,000 can often knock 15% to 30% off your premium for those coverages. It's a strategic balancing act—you have to decide how much you can comfortably afford to pay after a crash versus how much you want to save every month.

How Your Personal Details Shape the Final Price

The last part of the quote ties everything back to you. This is where the insurer’s math comes into play, calculating your specific risk based on your life and habits. It's the reason a quote for a teenager in Miami is worlds apart from one for a retiree in The Villages.

Here’s what they’re looking at:

- Your ZIP Code: Densely populated urban areas with more accidents and crime will always have higher rates.

- Your Car: The make, model, year, and safety ratings of your vehicle directly influence the cost to insure it.

- Your Driving Record: A clean history gets you the best price. Tickets, at-fault accidents, and DUIs will cause a significant hike.

- Your Coverage Limits: The more protection you buy beyond the state minimums, the higher your premium will be.

By carefully reviewing these details on your quote, you can see exactly what’s driving your cost. If the price is too high, you can instantly spot why—maybe your coverage limits are excessive for your needs, or maybe it’s time to raise that low deductible to get some breathing room in your monthly budget.

A Smarter Way To Compare Florida Insurance Companies

Finding the cheapest car insurance Florida has to offer isn't about calling the first company you see on a billboard. It's about playing the game a little smarter. You have to understand a fundamental truth: no two insurance companies see you, your car, or your driving history in exactly the same way.

Some insurers are actively looking for seasoned drivers with perfect records, offering them the best rates. Others have built their business model to be more competitive for families with a newly licensed teenager. Simply getting a few random quotes is like throwing darts in the dark—you might get lucky, but you probably won't hit the bullseye. The real secret is figuring out which companies are most likely to want your business and then making them compete for it.

Prepare For An Apples-to-Apples Comparison

Before you even think about getting a quote, the most critical first step is to get your paperwork in order. This isn't just busywork; it's the only way to guarantee that every single quote you receive is based on the exact same information. This is what we call a true "apples-to-apples" comparison, and it's how you spot the genuinely best deal.

Pull this information together before you start:

- Driver Details: The full name, date of birth, and driver's license number for every driver in your household who needs to be on the policy.

- Vehicle Information: You'll need the Vehicle Identification Number (VIN) for each car, along with the make, model, year, and an estimate of the current mileage.

- Driving History: Be completely upfront about any accidents or tickets from the past three to five years. Trust me, they're going to find out anyway when they run your record. It’s far better to get an accurate quote from the start.

- Current Policy: Grab your current insurance declaration page. It lists all your current coverage limits, which serves as the perfect starting point for your new quotes.

Taking 15 minutes to do this prep work can save you hours of frustration and prevent you from getting quotes that are all over the map. For more cost-cutting ideas you can implement before you even start shopping, check out these other practical tips on how to save money on car insurance.

Knowing Which Insurers Target Your Profile

Every insurance company has its own "secret sauce"—an algorithm that weighs risk factors differently. A 22-year-old in Tampa with a new Mustang is going to see wildly different prices from State Farm than they will from Progressive, and that's by design.

Some companies consistently come out on top for certain types of Florida drivers. For instance, if you're looking for comprehensive full coverage, State Farm is often a strong contender, with average rates hovering around $174 per month. But if you just need the state-mandated minimum liability coverage, Travelers frequently offers incredible rates at just $52/month, with State Farm ($67) and Mercury ($72) not far behind.

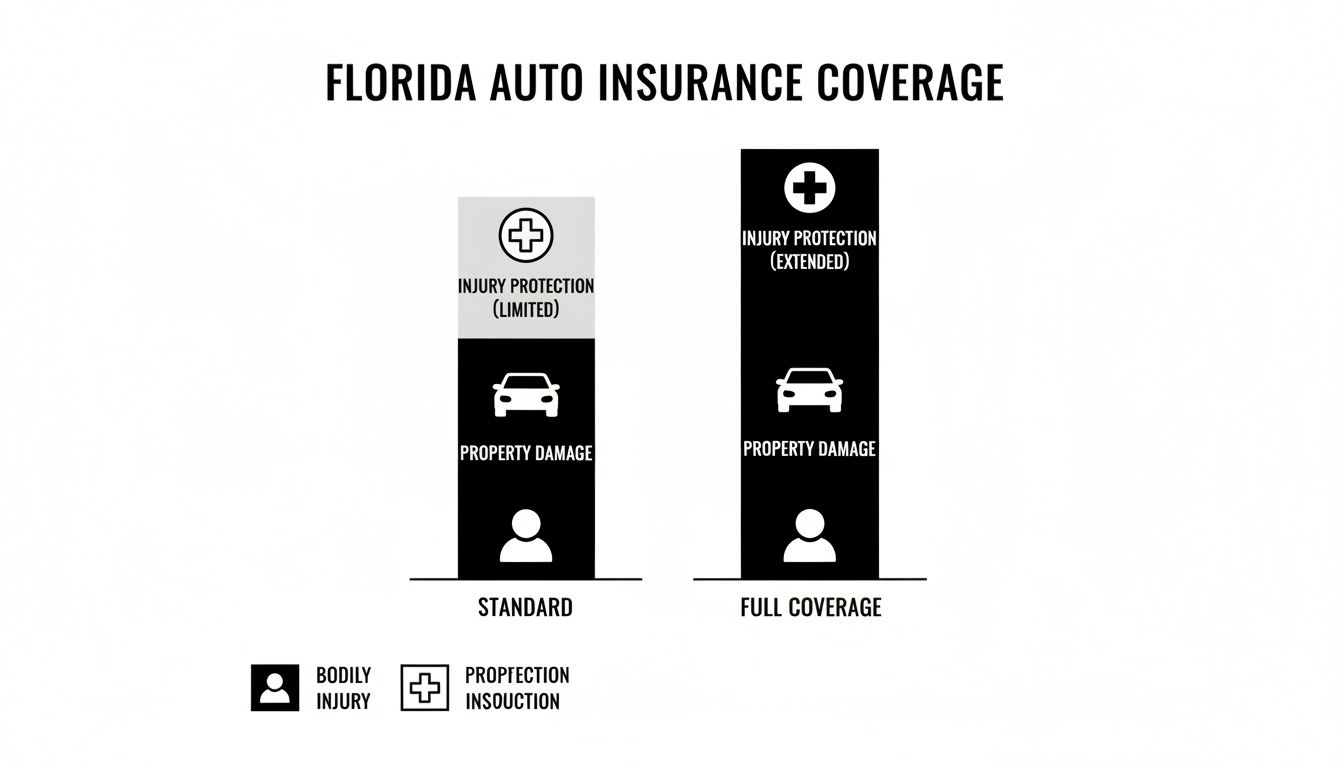

This visual gives you a great breakdown of what's actually included in a standard Florida auto policy.

It’s a simple look at how Bodily Injury Liability, Property Damage Liability, and Personal Injury Protection (PIP) are the essential pillars protecting you financially.

Comparing Top Insurers: A Snapshot of Potential Savings

To illustrate just how much rates can vary, here’s a look at what some of the top providers in Florida might charge. Remember, these are just averages—your actual quote will depend on your unique situation.

| Insurance Company | Avg. Minimum Coverage (Monthly) | Avg. Full Coverage (Monthly) | Best For |

|---|---|---|---|

| State Farm | $67 | $174 | Overall Value |

| Travelers | $52 | $230 | Basic Minimum Coverage |

| Geico | $78 | $215 | Drivers with Good Credit |

| Progressive | $105 | $265 | Drivers with an Accident |

| Mercury | $72 | $248 | Experienced Drivers |

Sample rates are for illustrative purposes. Your actual premium will vary.

This table makes it crystal clear: the company that’s cheapest for your neighbor might be one of the most expensive for you. The only way to know for sure is to compare.

Real-World Savings In Action

Let's look at a quick, realistic example. Meet Maria, a 45-year-old teacher in Orlando with a clean driving record and a paid-off 2021 Honda CR-V. She wants full coverage.

She spends an hour and gets three different quotes:

- Company A quotes her $250 per month. This is a huge national brand that just happens to be less competitive in dense Central Florida zip codes.

- Company B quotes her $195 per month. This insurer loves drivers like Maria—stable career, excellent credit, and zero claims.

- Company C quotes her $310 per month. This company’s specialty is high-risk drivers, so their rates for a squeaky-clean record like Maria’s are nowhere near competitive.

If Maria had just taken that first quote, she would have overpaid by $660 a year. By strategically comparing, she found the insurer that actually valued her low-risk profile and rewarded her for it.

The Single Most Effective Strategy: Comparing quotes isn’t just a good idea; it is the most powerful tool you have. The price for the exact same coverage can differ by hundreds, or even thousands, of dollars a year between companies.

Don't stop at three quotes. For the best results, aim to get five to seven quotes from a healthy mix of big national players (like Geico, Progressive, and State Farm) and smaller, regional Florida insurers who might surprise you. This diligence is what separates people who get an okay deal from those who find the absolute cheapest car insurance Florida drivers can get.

Unlocking Every Car Insurance Discount You Deserve

Once you've shopped around and found a company with a solid base rate, the real work begins. It’s time to start chipping away at that premium. Think of it as a scavenger hunt for savings, and trust me, most drivers qualify for way more discounts than they ever claim.

The problem is, insurance companies rarely volunteer this information. It’s on you to ask the right questions. Getting the cheapest car insurance Florida has to offer means you have to be your own best advocate, actively hunting down every possible price break. These small discounts can add up fast, turning an okay policy into a fantastic deal.

Discounts Based on You, the Driver

This category is all about who you are and how you drive. Insurers reward people they see as low-risk, so your good habits, profession, and even your grades can translate directly into savings.

- Good Student Discount: Don't overlook this one if you have a young driver on your policy. A full-time high school or college student with a "B" average (or better) is seen as more responsible, and that’s often worth a hefty discount.

- Safe Driver / Claims-Free Discount: This is the big one. If you've managed to stay accident-free and avoid tickets for a few years (usually 3 to 5), carriers will fight for your business with some of their best rates.

- Professional & Group Discounts: Are you a teacher, nurse, firefighter, or military member? Many insurers offer special rates for specific professions. The same goes for belonging to groups like AAA, AARP, or even a university alumni association.

Don't ever assume your agent knows you’re a member of a certain organization. You have to tell them.

Discounts for How You Manage Your Policy

How you set up and pay for your policy can open the door to some surprisingly easy savings. These discounts are designed to reward loyalty and efficiency.

One of the biggest money-savers is the multi-policy discount, or "bundling." When you buy your car insurance from the same company that provides your homeowners, renters, or life insurance, you can often knock 10-25% off each policy. Insurers want all your business, and they’re willing to pay for it.

Another no-brainer is the paperless and auto-pay discount. All you have to do is agree to get your bills via email and set up automatic payments. It’s a small discount, maybe a few percentage points, but it’s completely effortless.

Insider Tip: Always ask about a paid-in-full discount. Paying your six-month or annual premium all at once saves the insurance company a ton in administrative costs. They'll often pass a chunk of those savings—sometimes 5-10%—back to you.

Discounts Based on Your Vehicle

The car you drive matters. Its safety features and anti-theft systems have a direct impact on your final rate because they reduce the insurer's risk.

- Anti-Theft Devices: Factory alarms, engine immobilizers, and GPS trackers like LoJack can all earn you a discount.

- Safety Features: This is where modern cars shine. Make sure your insurer knows you have airbags, anti-lock brakes (ABS), electronic stability control, and even daytime running lights. Each one can chip away at your premium.

- New Car Discount: It might seem counterintuitive, but insuring a brand-new car can sometimes get you a small discount simply because newer models have the latest safety tech.

Double-check that your agent has an accurate list of every safety feature on your vehicle. It’s an easy detail to miss, but it all adds up.

The Hidden Gem: Defensive Driving Course Discounts

Here’s a strategy that far too many Florida drivers ignore: completing a state-approved defensive driving course. This isn't just for getting a ticket dismissed. It's a proactive way to prove you’re a safe, educated driver who deserves a lower rate.

In Florida, many insurers offer a voluntary discount of 5-10% for completing a driver safety program. This is a particularly great deal for mature drivers (over 55), but drivers of any age can often qualify. By investing just a few hours online, you can secure savings that pay for the course many times over and last for years. To see exactly how it works, you can explore the benefits of taking a driver safety course for an insurance discount and find out how to sign up.

The best part? If you do get a ticket, taking a Basic Driver Improvement (BDI) course does double duty. It stops points from hitting your license—preventing a rate hike—and can still qualify you for the voluntary discount. It’s a true win-win that keeps your record clean and your premiums low.

Keeping Your Driving Record Clean Is Your Best Weapon

While hunting for discounts is a great way to chip away at your premium, the real secret to consistently landing the cheapest car insurance Florida has is playing the long game. It all boils down to your driving record. Seriously, nothing else has a bigger impact on what you pay than your history behind the wheel.

A clean record is like a gold star for insurers. It tells them you're a low-risk client, which puts you in line for their best rates and preferred pricing. On the flip side, just one at-fault accident or speeding ticket can wipe out years of good-driver savings in a heartbeat.

The Real Price of a Florida Traffic Ticket

That fine you pay at the courthouse after getting a ticket? That’s just the down payment. The real financial sting comes from the insurance rate hike that inevitably follows. After an at-fault accident in Florida, drivers can expect their annual premiums to jump by a shocking 30-45%.

Think about that. If you’re paying $2,200 a year, your bill could suddenly shoot up to nearly $3,200. And this isn't a one-and-done penalty; that increase will haunt you for three to five years, costing you thousands of extra dollars for a single mistake. This is why knowing how to handle a ticket is so critical.

How Florida's Point System Works Against You

The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) uses a point system to track every moving violation. Each ticket adds points to your license, and if you rack up too many, you risk getting suspended. You can bet insurance companies are watching this scoreboard closely.

Here’s a quick rundown of what common mistakes will cost you:

- Speeding (15 mph or less over the limit): 3 points

- Running a red light: 4 points

- Causing an accident with property damage: 4 points

When it's time to renew your policy, your insurer pulls your record. If they see new points, it's an automatic red flag that tells them you've become a riskier driver. More points almost always mean a higher premium.

Your Game Plan for Handling a Ticket

Getting that flashing blue light in your rearview mirror is a sinking feeling, but it doesn't have to sabotage your insurance rates for the next few years. Florida gives you a powerful way out: you can elect to attend a state-approved traffic school. If you choose this path for a non-criminal moving violation, you can stop the points from ever hitting your license.

The Golden Rule: If you are eligible, always elect to take a traffic school course. This one simple move keeps the violation off the radar of your insurance company. If they can't see it, they have no reason to raise your rates. It transforms a potential multi-year financial penalty into a small, one-time inconvenience.

This screenshot shows an example of a Florida state-approved online traffic school, one of many where you can complete these courses from home.

Websites like this make it incredibly easy to find and sign up for a Basic Driver Improvement (BDI) course online, letting you knock it out on your own schedule.

Completing a Basic Driver Improvement (BDI) Course

For a typical ticket, you'll be taking the 4-hour Basic Driver Improvement (BDI) course. The whole process is refreshingly straightforward.

- Tell the Clerk of Court. When you go to pay your fine, you have to officially inform the clerk in the county where you got the ticket that you're electing to attend traffic school. Don't skip this!

- Sign up for an approved course. The FLHSMV website has a full list of approved providers. Many, like the one shown above, are 100% online.

- Complete the course. You'll brush up on Florida traffic laws and defensive driving techniques—good reminders for avoiding tickets in the future.

- Send in your certificate. Once you pass, you'll get a certificate of completion. It's your job to submit it to the Clerk of Court before their deadline to get full credit.

Following these steps keeps your record clean and your insurance rates stable. It is hands-down the most effective way to manage the fallout from a minor traffic violation and hold onto your status as a low-risk driver.

Answering Your Top Questions About Cheap Florida Car Insurance

Finding affordable car insurance can feel like a maze, and it's easy to get lost in the details. When you're trying to lock in the cheapest car insurance Florida has to offer, a few key questions always seem to pop up. Let's clear the air and get you the answers you need to make smart, money-saving decisions.

We’ve gathered the questions we hear most from Florida drivers just like you.

What’s the Bare Minimum Car Insurance I Need in Florida?

Florida is a "no-fault" state, which means there's a specific floor for what you absolutely must have to drive legally. Every registered vehicle needs a policy with at least:

- $10,000 in Personal Injury Protection (PIP). This is for your medical bills after a crash, no matter who caused it.

- $10,000 in Property Damage Liability (PDL). This covers the cost of repairs to someone else's car or property if you're at fault.

But here's the honest truth: this minimum coverage is incredibly thin. A single serious accident can easily blow past these limits, and you'll be on the hook for every dollar above them. It's the legal minimum, not the recommended amount for real financial protection.

Can I Really Get an Insurance Discount with an Online Traffic School Course?

Yes, and it's one of the easiest ways to shave some money off your premium. Many Florida insurance providers offer a voluntary discount—often between 5-10%—just for completing a state-approved defensive driving course online.

Think of it this way: if you get a ticket, taking a Basic Driver Improvement (BDI) course is a no-brainer. It keeps the points off your license, which prevents your insurance company from jacking up your rates. It’s a classic win-win for keeping your record clean and your wallet full.

Why Is My Insurance Quote So Much Higher in Miami Than in Tallahassee?

It all comes down to your ZIP code. Where you live and park your car is a huge piece of the insurance puzzle. Big city life in places like Miami, Tampa, or Orlando means you'll almost always pay more, and it's not personal—it's just risk assessment.

Densely populated areas have more cars on the road, which naturally leads to more accidents and more insurance claims. On top of that, vehicle theft and vandalism rates are typically higher. Insurers see this increased risk and price their policies accordingly, which is why rates in a quiet Panhandle town will look very different from those in South Florida.

Does My Credit Score Actually Matter for Florida Car Insurance?

It absolutely does. In Florida, insurers are legally allowed to use a credit-based insurance score to help set your rates. Years of industry data have shown a solid link between a person's credit history and the likelihood they'll file an insurance claim.

Because of this, drivers with strong credit scores usually get offered much better rates. It might not seem fair, but it's a reality of the system. If you're playing the long game, improving your credit is one of the most powerful moves you can make to get cheaper car insurance down the road.

Ready to take control of your driving record and unlock potential insurance savings? BDISchool offers Florida DHSMV-approved online traffic school courses that are fast, easy, and affordable. Whether you need to dismiss a ticket or earn a voluntary discount, we make it simple to protect your license and lower your rates. Enroll today at https://bdischool.com.