So, you want to know the real story: how much does defensive driving lower insurance? Let’s make it simple. Taking a defensive driving course is like getting a cheat code for your insurance costs. You spend a little bit of time and a small amount of money now, and you can lower your insurance bill by 5% to 20%. And that discount can last for years!

This guide will explain everything in simple terms, so it’s easy to understand, even for a fourth-grader. We’ll show you how a quick, state-approved Florida online traffic school can put money back in your pocket.

The Real Deal on Insurance Savings from Defensive Driving

Taking a state-approved defensive driving course is a smart move. Insurance companies look at drivers and try to guess who is more likely to have an accident. This is called “risk.” When you finish a course, you are showing them that you are a safe driver.

Because safe drivers have fewer accidents, insurance companies are happy to give them a discount. It’s a win for everyone. You learn to be a better driver, and they have a customer who is less likely to need them to pay for a crash. This isn’t just a few pennies. A 10% discount on a $1,500 yearly insurance bill means you save $150. The discount usually lasts for three years, so that’s $450 saved! It makes the small cost of the course a great deal.

So, How Much Can You Actually Save?

Let’s look at the numbers. Imagine your car insurance bill is a big pizza. A defensive driving discount is like getting a few slices for free. To see what this looks like with real money, check out this table.

Potential Annual Savings on Car Insurance

This table shows how a defensive driving discount can reduce your yearly insurance premium.

| Annual Premium Before Discount | Potential Discount | Annual Savings |

|---|---|---|

| $1,200 | 10% | $120 |

| $1,500 | 10% | $150 |

| $2,000 | 10% | $200 |

| $2,500 | 10% | $250 |

As you can see, the more you pay for insurance, the more a discount helps you save. It’s easy math that helps you.

In Florida, the law helps with this. Florida Statute 318.14 says that if you get a ticket, you can choose to go to a traffic school. If you do, you won’t get points on your license. This helps stop your insurance bill from going up. It’s like getting a second chance. You can see the full law on the Florida Senate government website.

At BDI School, our courses are made to be easy, fast, and, best of all, 100% approved by the state of Florida. We have different courses for whatever you need.

Whether you are a new driver, need to take care of a ticket, or just want that great insurance discount, there’s a driver education course for you.

While a defensive driving school is a super easy way to lower your insurance bill, it’s not the only way. It’s always a good idea to look for other tips to save money on insurance and save even more. Using a few different tricks is how you become a master at getting a low insurance bill.

Why Insurance Companies Give You a Break for Being Safer

Have you ever wondered why your car insurance company is so happy to lower your bill just for taking a driving class? It’s not just because they are nice. It’s because it’s good for their business, and you get to save money because of it.

Think of it like this: your insurance company is making a bet on how you drive. A driver who has a lot of accidents is a bad bet. But a driver who just finished a Basic Driver Improvement (BDI) course? You’ve just shown them you care about being safe. You have become a much better bet.

It All Comes Down to Risk

The whole insurance world is about managing risk. Every time one of their customers has an accident, the company has to pay for car repairs, doctor bills, and more. Those payments can be very big.

So, when you choose to sign up for and pass a defensive driving school course, you’re sending them a clear message: “Hey, I’m less likely to cost you money!”

Because you have lowered your risk, they are happy to give some of their savings back to you. That discount on your bill isn’t a gift; it’s a thank-you note for making their job easier.

Big insurance companies know this works. Companies like GEICO and State Farm often give discounts between 5% and 10% for finishing a state-approved course. For most drivers, that can mean saving around $170 a year. Since the discount usually lasts for three years, that’s a lot of money back in your pocket for just a few hours of your time.

More Than Just a One-Time Discount

Saving money right away is great, but the real benefit happens over time. Finishing a course is not just one thing; it proves you are a responsible driver, and insurance companies love that. It helps you build a good, clean driving record.

A clean driving record, along with your course certificate, is the best tool for keeping your insurance rates low year after year.

By taking a course, you’re not just saving money; you’re learning important skills. Knowing these defensive driving techniques can help you stay out of accidents, which is the very best way to keep your insurance costs down.

Our courses here at BDISchool are built to be quick, easy, and helpful. We offer the best tools to solve your driver education needs in a fast way, and you get your certificate right away. The sooner you finish, the sooner you can start saving.

Seeing the Savings in Action Across Florida

Okay, let’s talk about real money. Percentages are one thing, but what you really want to know is how much does defensive driving lower insurance for real people here in Florida. It’s about turning a few hours of your day into real cash that stays in your wallet.

Think about it like this: Picture a young person, let’s call her Sarah, driving in busy Miami. Her car insurance is a little expensive, as it often is for younger drivers. But after taking a BDI course, she gets a 10% discount. That little bit of savings means she can go out to dinner with friends one extra time each month. It’s not just a number on a paper; it’s a real-life bonus.

From The Villages to Key West, Real People are Saving

Now, let’s visit David, a retired man in The Villages who loves to drive. He took one of our Florida approved traffic school courses and got a 15% discount. That savings paid for a weekend trip to see his grandkids. The money he saved turned into a happy memory.

These are not just pretend stories; they are examples of what happens every day. Let’s look at the numbers:

- A 32-year-old in Florida paying $1,500 a year could save $150 with a 10% discount.

- A 60-year-old driver paying $1,000 a year might get a 20% discount, saving $200 every year.

This is a real chance for drivers all over Florida to save money. Our online traffic school courses are made to be quick and easy, so you can get your certificate and start saving right away.

Here’s the best part: these discounts usually last for three full years. Sarah’s extra dinner out isn’t a one-time thing—it’s a reward she gets for 36 months. That’s how a simple driver education course pays for itself again and again.

Once you see how it works in real life, it’s an easy choice. Spending a little bit of time can make a big difference in your yearly spending. If you want to find even more ways to save, check out our guide on how to get cheaper auto insurance. It’s all about making smart choices to keep more of your money.

Your Simple 4-Step Plan to Claim Your Discount

Okay, let’s talk about how to turn those safe driving skills into money in your bank account. Getting your insurance discount is much easier than you think. You don’t have to fill out lots of confusing papers. It’s a clear, simple path from taking a quick online course to seeing your insurance bill go down.

This is so real that it’s even part of Florida’s laws. Florida Statute 627.0652 is like the state’s way of saying “yes!” to these discounts. It encourages insurance companies to offer them. You can read the law yourself on the official state legislature website, but it just means Florida wants to reward you for being a safer driver.

Now, let’s explain how you do it.

Your 4-Step Action Plan to Lower Insurance

Follow these easy steps to finish your course and get your discount. It’s really this simple!

| Step | Action to Take | Helpful Tip |

|---|---|---|

| 1 | Check With Your Insurance Agent | Call or email them first. Ask if they offer a discount and how much it is (5-15% is normal!). Ask where to send your certificate. |

| 2 | Enroll in a Florida-Approved Course | Sign up for a course that the state of Florida approves. Our BDISchool courses are all 100% FLHSMV-approved. |

| 3 | Complete the Course & Get Your Certificate | Go through the easy online lessons when you have time. When you’re done, you get your certificate of completion right away. No waiting! |

| 4 | Send Your Certificate & Start Saving | Send the certificate to your agent the way they told you to in Step 1. Then, wait for the discount to show up on your next bill! |

That’s it! Just four easy steps to a lower insurance bill for the next few years. Now, let’s look at each step a little closer.

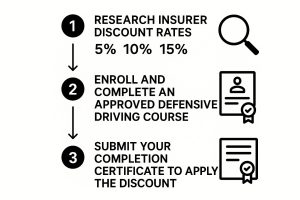

Step 1: Check With Your Insurance Agent

First, call or email your insurance agent. Just ask, “Do you offer a discount for taking a defensive driving course?” They will almost always say yes, but it’s good to ask them directly.

While you are talking to them, ask two more questions:

- How much is the discount? (It’s usually between 5-15%!)

- How should I send you the certificate when I am done?

This quick five-minute talk makes everything else super easy.

Step 2: Enroll in a Florida-Approved Course

Next, you need to sign up for a course that is approved by the state of Florida. Not just any class you find online will work. The good news is that all of our driver education courses at BDISchool are 100% approved by the Florida Department of Highway Safety and Motor Vehicles (FLHSMV).

This is the most important step to connect your work to your savings.

You can even see the full list of state-approved schools, including us, right on the official FLHSMV website.

Step 3: Complete the Course and Get Your Certificate

Now for the fun part. Our online traffic school is made to be easy, fast, and maybe even fun. You can do it from your home, on your lunch break, or whenever you want. The second you finish, your certificate of completion is ready. Instantly. You don’t have to wait for it in the mail.

Step 4: Send Your Certificate and Start Saving

Last, the best part! Take that certificate and send it to your insurance agent, just like you talked about in Step 1. They will do the rest, add the discount, and you will see the savings on your next bill. It really is that easy.

By finishing an approved BDI course online, you’re doing more than just completing a task. You’re making a smart choice for your safety and your money—a choice that helps you for years.

Ready to start? You can sign up right now and be on your way to a lower insurance bill today. Just go to our courses page to find the right one for you.

Keep Points Off Your License and Your Rates Down

The discount we talked about is great, but that’s just the beginning. The real power of a Basic Driver Improvement (BDI) course is how it protects your driving record. This is where you really see the biggest savings when you ask, “how much does defensive driving lower insurance?”

Let’s be real, getting a traffic ticket is no fun. But the points that come with it are the biggest problem. Think of points as bad marks on your record that tell your insurance company you are a “higher risk” driver. Even one ticket can make your insurance bill go up for years.

Use Traffic School to Wipe the Slate Clean

Here’s the good news. Florida law gives you a way out for small driving mistakes. When you get a ticket, you can choose to take a BDI course—what most people call traffic school Florida—and stop those points from ever going on your license.

This isn’t a secret trick; it’s a smart system made to help drivers who want to get better.

The rule for this is Florida Statute 318.14. It says drivers can take a driver improvement course instead of getting points for most tickets. It gives you a chance to fix a mistake and avoid paying a lot more for insurance.

Basically, it’s a do-over. It’s a chance to erase a mistake and avoid the money problems a ticket can cause.

The Two-in-One Power of a BDI Course

Think of our BDI course like a tool with two great uses. First, it can get you that nice discount on your insurance. But second, it’s a strong shield that protects you from higher bills that come with ticket points.

Without a driver safety course, one small speeding ticket could make you pay more for insurance for three to five years. Ouch. By taking a quick and easy BDI driving course, you stop that from happening. The National Highway Traffic Safety Administration (NHTSA), a part of the U.S. government, always says that driver education is very important for keeping roads safe for everyone.

It’s a small amount of time that stops a long-term money problem and keeps more of your money with you.

Want to see exactly how this works? Check out our guide on using a course to remove points from your license.

Answering Your Top Questions About Driving Discounts

Do you still have a few questions? Good. When it’s about your driving record and how much you pay for insurance, you should ask questions. We get questions all the time from Florida drivers like you, so we put the most common ones right here.

Think of this as your own list of answers to help you understand everything. We’ll talk about how long the discount lasts, what to do after you pass your online traffic school course, and more. Let’s get you ready to save money.

How Long Does the Insurance Discount Last?

This is a big question. It helps you know if taking a course is worth your time. The great news is that the discount you get from a defensive driving school usually lasts for three full years. That’s 36 months of lower bills for just a few hours of your time. That’s a great deal!

Even better, you can do it again. In most cases, when your three years are almost over, you can just take another quick course to get the savings for another three years. It’s a great way to keep your insurance bills low for a long time. Just be sure to call your insurance company to check their rules.

Do All Florida Insurance Companies Offer This Discount?

Almost all of them do, but we can’t say 100% for sure. Most big insurance companies in Florida are happy to give you a discount for finishing a state-approved BDI course. Why wouldn’t they? It shows you’re a safer driver, which means you’re less likely to cost them money.

But, the exact discount amount and who can get it can be different for each company. The smartest thing to do is call your agent before you sign up. In five minutes, you can make sure they offer the discount and find out exactly how much you’ll save.

Key Takeaway: You can choose to take a Basic Driver Improvement (BDI) course to avoid getting points for most common tickets, like for speeding. It’s a great tool for keeping your driving record clean and stopping your insurance from going up. It’s also important to consider support needs. People with a disability or other functional needs should check with their insurance provider for any special considerations or additional discounts available.

What Do I Do After I Complete the Course?

This is the easiest part. The moment you finish our very simple BDI course online, your certificate of completion is ready right away. You don’t have to wait for it in the mail.

After that, you just have one thing to do: send that certificate to your insurance company. Most companies have a simple way to upload it on their website, or you can email it. We make it very easy to get your proof so you can start saving money right away. For a closer look, you can learn more about what traffic school is and all the ways it can help you.

Of course, insurance is a big topic, and discounts are just one part of it. Drivers sometimes have other questions about their insurance, like what extras are covered, such as car key replacement insurance, to understand their full policy.

Ready to take control of your insurance rates and become a safer driver? BDISchool offers the premier tools to solve your driver education needs in a fast and easy way. You get your certificate instantly upon completion. Register today and start your journey to savings