Wondering how to lower insurance premiums? You have more power over your rates than you might think. For instance, the best ways to save money involve a few key areas. These include changing your policy details and looking for discounts. In addition, making choices that improve your driver profile can also help.

Your Quick Guide to Lowering Insurance Premiums

Let’s start with practical ways to save. This section is all about immediate savings you can get right now. Therefore, think of it as your cheat sheet for quick wins. After this, we will cover long-term strategies.

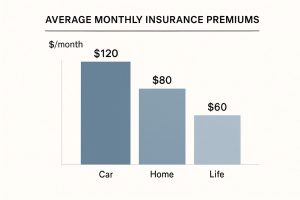

First, it helps to see where your insurance money goes. This chart gives you a quick look at average monthly premiums for different insurance types.

As you can see, different kinds of coverage come with very different costs. This shows where the biggest chances for savings often are, especially with auto insurance.

Immediate Actions To Take

You can take several actions today to start lowering your insurance costs. Some are as simple as a quick phone call. However, others might take a little more work. The secret is knowing what to ask for and where to look. Even small changes can add up to big savings on your bill.

For example, one of the easiest moves is to adjust your policy’s deductible. Just by raising your deductible from $500 to $1,000, you could see your premium drop by 15% to 30%. Another great strategy is bundling multiple policies. Combining your home and auto insurance with one company can often slice your total bill by 10% to 25%. Insurers like this because it is more efficient for them. As a result, they pass those savings on to reward your loyalty.

Key Takeaway: The link between your deductible and premium is a simple trade-off. When you agree to pay more for a claim, your insurer gives you a lower premium.

To give you a clearer picture, I’ve put together a table. It breaks down some of the most effective ways to lower your premiums right away. It shows the action, the savings you can expect, and the effort it takes. Use this as a guide to pick your first move.

Immediate Actions to Lower Your Insurance Premiums

This table outlines common strategies, potential savings, and the effort required for each. It provides a quick reference for immediate action.

| Action | Potential Savings | Effort Level |

|---|---|---|

| Increase Your Deductible | 15%–30% | Low |

| Bundle Policies | 10%–25% | Low |

| Ask for Discounts | 5%–20% | Low |

| Improve Credit Score | Varies | Medium |

| Reduce Coverage | Varies | Medium |

| Shop Around for Quotes | 10%–20% | High |

Looking at this, it’s clear that a few low-effort actions can lead to big savings. For instance, bundling or asking about discounts can help a lot. Once you have done those, you can move on to the higher-effort strategies.

Cracking the Code: How Insurance Companies Decide Your Rate

Do you ever feel like your car insurance premium is just a random number? I get it. But there is actually a method to it. Insurance companies use a complex set of factors to figure out how much you will pay. Understanding these factors is your first step toward finding ways to lower your bill.

The good news is that you have more control than you might think. While some factors are set, others are within your power to change. Let’s break down what insurers are really looking at.

The Levers You Can Pull

This is where you can actively work to lower your premium. An insurer’s main job is to predict how likely you are to file a claim. If you seem to be less of a risk, they will offer you a better rate.

Your driving record is the most important factor. It is a direct reflection of your habits behind the wheel. A clean record with no speeding tickets or at-fault traffic incidents shows you are a safe driver. On the other hand, a history of violations signals higher risk. Therefore, your premiums will definitely reflect that.

Then there is your credit-based insurance score. This surprises a lot of people. In most states, insurers look at your credit history to see how reliable you are. It is not about how much money you have. Instead, it is about responsibility. Statistics from the Federal Trade Commission show a link between financial habits and safer driving. This can lead to serious savings.

Do not forget the car you drive. This one is pretty simple. A sedan with top safety ratings and easy-to-find parts will be cheaper to insure. It costs less than a sports car or a model that is often stolen. The Insurance Institute for Highway Safety (IIHS) provides vehicle safety ratings that can help you choose a safer, less expensive car to insure.

A key takeaway here is to pay attention to your annual mileage. If you now work from home or just drive less, tell your insurer. Lower mileage means less time on the road and less risk. This often leads to a nice discount.

The Factors You’re Stuck With

Now for the frustrating part. Some factors that affect your premium are based on broad statistics. These are completely out of your hands. You cannot change them, but it’s good to know they exist.

- Your Age and Gender: It is a statistical fact that young drivers have more collisions. The National Highway Traffic Safety Administration (NHTSA) reports that teen drivers have higher crash rates. This is why they often face very high premiums. The rates tend to come down as you get older and gain more experience.

- Your Geographic Location: Where you park your car at night matters a lot. A driver in a busy city with heavy traffic will pay more. This is because there is a higher risk of crashes, crime, and vandalism. Someone in a quiet, rural town will pay less. It’s all about the risk in your zip code.

All these pieces come together to form your unique risk profile. You cannot change your age or move just for cheaper insurance. However, you can focus on what is in your control. Maintaining a spotless driving record and a healthy credit score are your most powerful tools.

Finding Every Discount You Deserve

Think of insurance discounts as hidden money. But here’s the catch: you almost always have to ask for them. Insurance companies have a long menu of possible discounts. Yet, many drivers leave that money on the table because they do not know what is available.

Most of us know about the big ones, like bundling home and auto policies. The real savings, though, often lie in the details. This is where you can be proactive and make a real dent in your premium.

Uncovering Vehicle-Based Discounts

Your car itself might be your best ticket to a lower bill. Insurers love features that make a vehicle safer or harder to steal. They will often reward you for them. The next time you talk to your agent, be ready to ask about your car’s equipment.

A lot of modern cars come loaded with safety tech. See if your car has any of these:

- Anti-lock brakes (ABS): This is standard now, but some insurers still offer a small break for it.

- Daytime running lights: They make your car more visible, which can cut down on collisions.

- Electronic stability control (ESC): This is a huge one. It helps you maintain control and avoid skids.

- Anti-theft systems: If you have an alarm or a vehicle recovery device, it can lower the comprehensive part of your premium.

Each of these features lowers the odds of you filing a claim. That is good news to an insurer. While one discount might be small, they can add up.

Expert Tip: Never assume your insurer automatically knows every feature on your car. I’ve seen it happen. Come prepared with a list and ask for every single discount you should get.

Discounts for Your Driving Habits and History

Beyond the car you drive, how you drive is a goldmine for discounts. This is where being a safe, responsible driver pays off. The most common one is the good driver discount. It usually kicks in after you have kept a clean record for three to five years.

Voluntarily completing a state-approved defensive driving class is another great way to lower your rate. It shows your insurer that you are committed to being a safer driver. In many situations, it can also help with a recent ticket.

Finally, do not forget to mention who you are and where you work. Many insurers give discounts to members of specific groups, including:

- Alumni associations

- Professional organizations

- Military members, both active and retired

- Federal government employees

These are often called “affinity group” discounts. They can be surprisingly large. Finding these savings just comes down to knowing the right questions to ask.

Fine-Tuning Your Policy for Real Savings

Alright, let’s get into the details of your policy itself. This is where a few smart changes can have a big impact on what you pay. It’s all about finding the right balance between what you pay and the coverage you actually need.

One of the quickest ways to see a drop in your premium is to look at your deductible. A deductible is the amount you agree to pay for a claim before your insurance company starts to pay.

Think of it as a trade-off. By agreeing to take on more of the initial financial risk, your insurer rewards you with a lower bill. For instance, moving from a $500 deductible to a $1,000 one can often cut your premium by 15% to 30%. You just have to be comfortable having that higher amount ready if you need it.

Does Your Coverage Still Make Sense?

Life changes fast. The insurance you needed last year might not be right for you today. The full coverage that was essential for your new car might be too much for an older vehicle. I always tell people to review their policy at least once a year.

Take a hard look at your car’s current value. Is paying for both collision and comprehensive coverage still worth it?

- Collision Coverage: This pays for repairs if your car hits something, like another vehicle or a pole.

- Comprehensive Coverage: This handles damage from other things, like theft, a falling tree branch, or hail.

Here’s a practical rule: if the annual cost of your collision and comprehensive coverage is more than 10% of your car’s value, you should think about dropping them. For an older car, that could save you hundreds of dollars each year. You can check your car’s value on a site like Kelley Blue Book or Edmunds.

State Spotlight: California Driving Laws

Each state has unique driving regulations. For example, in California, the law is very strict about cell phone use.

- Hands-Free Law: California drivers are not allowed to hold a phone or any electronic device while driving. It must be mounted on the dashboard or windshield, and you can only use a single swipe or tap on the screen. You can find more details at the California Department of Motor Vehicles (CA.gov).

- Move Over Law: When you see an emergency vehicle with flashing lights on the side of the road, you must move over to another lane if it’s safe to do so. If you can’t move over, you must slow down to a safe speed. This law helps protect law enforcement officers and emergency workers.

Don’t Just Renew—Shop Around and Negotiate Your Rate

When it comes to car insurance, loyalty does not always pay. Insurers are always changing their rates based on new data. That means the company that gave you the best deal last year might be more expensive this year.

This is why one of the best ways to lower your car insurance bill is to become a smart shopper. It’s not just about getting a lower number. It’s about understanding what you’re paying for.

Compare More Than Just the Final Price

Getting a cheap quote feels great, but the lowest price is not the whole story. A cheap premium will not help if the company is hard to deal with when you need to file a claim. You need to look at the bigger picture.

When you start gathering quotes, you are not just comparing prices. You are checking companies for a very important job.

Comparing Insurance Providers Beyond Price

This table will help you look past the premium. It helps you check the things that matter when you need your insurance most.

| Evaluation Factor | What to Look For | Where to Find Information |

|---|---|---|

| Customer Service | Are they helpful, or do you hear stories about long wait times and unreturned calls? | Check online reviews and consumer complaint data from your state’s department of insurance. |

| Claims Handling | How smoothly and fairly does the company process claims? This is where an insurer shows their value. | Look for claims satisfaction ratings from consumer reports and state insurance websites. |

| Financial Stability | You need to know the company has the money to pay your claim, no matter how large. | Check ratings from independent agencies that assess the financial health of insurance companies. |

Taking a few extra minutes to check these factors helps you find a policy that gives you a good price and peace of mind.

How to Negotiate With Your Current Insurance Company

Did you get a few better quotes from other carriers? Great. Your work is not done yet. Now you have something to negotiate with. Many people feel awkward about negotiating with their insurer. But you’d be surprised how often they are willing to work with you to keep your business.

Pick up the phone and call your current agent.

Start by reminding them how long you’ve been a customer. Then, calmly explain that you have a better offer for the same coverage. Be ready to share the specific premium you were quoted. This shows them you’re serious and have done your homework.

It is often cheaper for an insurance company to give a loyal customer a discount than to find a new one. This simple fact is your biggest advantage.

This is how the market works. The U.S. Department of Transportation (USDOT) often reports on industry trends. Market pressures create opportunities for consumers like you to save money. Taking the time to shop, compare, and negotiate puts you in control of your insurance costs.

Answering Your Top Questions About Lowering Insurance Costs

It’s one thing to have a strategy. It’s another to know how to handle specific situations. After helping drivers with this for years, I’ve noticed a few questions come up again and again. Let’s clear the air on some of the most common ones.

How often should I shop for new insurance?

My advice is to check for new quotes at least once a year. Do this about a month before your current policy renews. This simple habit keeps you from paying a higher rate. It also shows you what the market is offering.

But do not just wait for your renewal date. You should get fresh quotes anytime you have a major life event. These moments can completely change how an insurer sees you.

Get new quotes when you are:

- Moving to a new home: Your ZIP code has a big impact on your premium.

- Switching vehicles: The car you drive is a core part of the pricing.

- Getting married: Married couples often get a nice discount.

- Boosting your credit score: A better credit report can unlock savings.

Being proactive is the key. You do not want to overpay just because it’s easier than looking around.

Will one speeding ticket ruin my insurance rate?

Deep breath. A single ticket usually will not destroy your rates, but it will probably make them go up. How much depends on a few things: how fast you were going, your driving record, and your insurance company’s rules. For a minor ticket on a clean record, the increase might be small.

The good news is that you often have options. Many states and insurers will give you a break if you take a state-approved driver improvement course. Completing one can prevent points from landing on your license. It’s the points that really get an insurer’s attention. Check your state’s official DMV or DOT website to see if this is an option for you.

Can I get a discount for taking a driving course?

Absolutely. Many insurance providers offer a discount for voluntarily completing an approved defensive driving course. Why? Because it proves you are serious about being a safe driver.

Here’s the inside scoop: When you take a course like this, insurers see you as a lower-risk customer. You are learning modern techniques to avoid traffic incidents. That reduces the odds you will file a claim.

The discount you get will vary, but it is often in the 5% to 10% range. Those savings can add up quickly. Before you sign up, just give your agent a quick call to make sure they offer the discount.

How do points on my license affect my insurance?

Points on your license are a major red flag for insurance companies. Each traffic violation, like speeding or running a red light, adds points to your record. More points signal to insurers that you are a high-risk driver. As a result, they will likely increase your premium. Some states allow you to take a defensive driving class to remove points. You can check your state’s official government website for driving rules and point systems.

What are the biggest risks for teen drivers?

Teen drivers face higher risks on the road. According to the Governors Highway Safety Association (GHSA), the main risk factors include driver inexperience, speeding, and distraction. Driving with other teen passengers also increases the crash risk. Parents can help by setting clear rules and modeling safe driving habits.

By using these tips, you can take control of your insurance costs. Focus on being a safe driver, maintaining a good credit score, and reviewing your policy regularly. Furthermore, remember to ask for every discount you deserve. Your wallet will thank you.