Yes, taking a defensive driving class can definitely lower your insurance bill. It’s one of those rare win-win situations. Insurance companies see it as you taking the initiative to become a safer driver, and they’re often willing to reward that effort with a nice little discount.

Think of it as a tangible thank-you for being proactive about safety on the road.

How Safe Driving Actually Saves You Money

At its core, insurance is all about risk. When an insurer looks at your policy, they’re trying to figure out how likely you are to get into an accident and file a claim. Someone who voluntarily completes a course to spot hazards, react quicker, and drive more defensively is simply a lower risk.

That’s where the savings come in. By proving you’ve brushed up on your skills, you become a much more attractive customer.

Most insurance providers offer a discount somewhere between 5% to 20% for completing an approved course. And the best part? It’s not just a one-off savings. This discount is usually applied to your premium for up to three years, meaning that small investment in the course pays you back over and over again.

What Does This Mean for Your Wallet?

To give you a clearer picture, let’s break down the key financial benefits of completing a defensive driving course.

| Benefit Category | Typical Range or Detail |

|---|---|

| Direct Premium Discount | 5% – 20% reduction on your premium |

| Discount Duration | Typically lasts for 3 years |

| Return on Investment | The course often pays for itself many times over |

| Indirect Savings | Fewer accidents means avoiding deductibles & rate hikes |

Ultimately, the goal is to keep more money in your pocket while making you a safer driver on the road.

The value isn’t just about that initial price drop.

- Immediate Premium Reduction: This is the most obvious perk. You’ll see your monthly or annual insurance payments go down right away.

- Sustained Long-Term Savings: That discount sticks around for a few years, adding up to significant savings over time.

- Fewer Accidents, More Savings: The real value comes from the skills you learn. By avoiding even one minor fender-bender, you save yourself the headache of deductibles, claims, and potential rate increases down the line. To keep building on this, you can check out more essential defensive driving tips that reinforce these good habits.

How Becoming a Safer Driver Reduces Your Premium

At its core, car insurance is all about managing risk. When you sign up for a defensive driving course, you’re sending a clear signal to your insurance company: “I’m a safer bet.” You’re actively working to become a lower-risk driver, and in their eyes, that makes you a much better investment to cover.

Think of it this way—insurers are basically placing a wager on your driving habits. By completing a safety course, you’re stacking the odds firmly in your favor.

This isn’t just a theoretical change, either. It’s a direct result of the practical skills you pick up. These courses move way beyond the basic rules of the road you learned for your driver’s test. You’ll learn proactive techniques like how to anticipate what other drivers might do, how to maintain a safe “cushion” of space around your car, and how to react calmly and correctly when the unexpected happens.

Every one of these skills chips away at the statistical chance you’ll end up in an accident. And you can be sure the insurance companies have the data to prove it. They know that drivers with this kind of training simply file fewer claims.

The Direct Link Between Skills and Savings

It’s actually a pretty simple equation: better driving habits lead to fewer accidents and traffic tickets. To really get a feel for the savings, it helps to understand the flip side of the coin, like seeing how a speeding ticket can affect your insurance rates.

By staying out of trouble on the road, you keep your driving record clean, which is the number one factor in keeping your premiums down. The skills from a defensive driving course are the best tools you have to protect that record.

A defensive driving course is an investment in your skills that pays direct dividends. By reducing your risk on the road, you are also reducing the financial risk for your insurer, a change they are happy to reward with a lower premium.

The proof is in the pudding—or in this case, the data. Studies have shown that these courses lead to a major drop in collision rates. In fact, some programs have been shown to reduce accident rates by as much as 21%. This kind of clear, data-backed improvement is exactly why insurers are more than willing to offer these valuable discounts.

How Much Can You Actually Save on Insurance?

It’s one thing to hear that a defensive driving course can lower your insurance bill, but it’s another thing entirely to see what that means for your wallet. The discount you earn translates directly into real, tangible savings, making the course a pretty savvy financial move for most drivers.

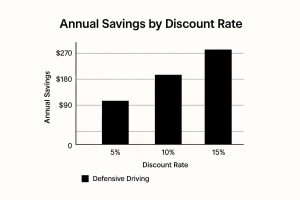

Let’s put some real numbers to this. Say your annual car insurance premium is $1,800. A pretty standard 5% discount would put $90 back in your pocket every year. If your provider offers a 10% discount—which is very common—that saving jumps to $180 a year.

This chart gives you a quick visual of how those savings stack up based on that $1,800 premium.

As you can see, even a small percentage adds up. And remember, this discount usually lasts for three years, so those yearly savings really start to multiply.

What Determines Your Discount Rate?

Of course, the final number isn’t set in stone. The exact discount you get depends on a few key things, so it’s less of a one-size-fits-all deal and more of a personalized benefit.

Here’s what typically influences your savings:

- Your Insurance Company: Every provider has its own rules. While most offer something in the 5% to 15% range, some are more generous than others.

- State Regulations: Where you live matters. Some states have laws that mandate specific discounts for drivers who complete an approved safety course.

- Your Driving History: A driver with a spotless record might see a different discount offer compared to someone taking the course to get points removed from their license.

To get a feel for how these discounts play out across different premium amounts, check out the table below. It shows how even a modest discount can make a big difference, especially if you’re already paying a higher premium.

Estimated Annual Savings from Defensive Driving Discounts

| Annual Insurance Premium | Savings with 5% Discount | Savings with 10% Discount | Savings with 15% Discount |

|---|---|---|---|

| $1,200 | $60 | $120 | $180 |

| $1,800 | $90 | $180 | $270 |

| $2,400 | $120 | $240 | $360 |

These numbers highlight the simple math: the more you pay for insurance, the more a percentage-based discount will save you each year. It really puts the value of a small, one-time course fee into perspective.

The best way to figure out your exact savings? Just call your insurance agent. Ask them point-blank what percentage discount they give for completing a state-approved defensive driving course. That one quick phone call clears up any guesswork.

Once you have that number, you can easily compare the small, upfront cost of the course against the long-term savings. For even more ways to trim your bill, check out our guide on how to lower auto insurance. Taking a few proactive steps is the key to making sure you aren’t paying a penny more than you have to.

Determining If You Qualify for the Discount

So, does taking a defensive driving course actually lower your insurance bill? In many cases, the answer is a resounding yes, but it’s not a one-size-fits-all deal. Think of it less like a universal coupon and more like a rewards program with its own specific entry rules.

Insurance companies set their own criteria, so you’ll want to do a little homework before you sign up for a course. The requirements can vary quite a bit from one provider to the next, often depending on things like your age, driving record, and where you live.

Common Eligibility Factors to Consider

Before you even pick up the phone to call your agent, it helps to have an idea of what they’ll be looking for. Most of the time, eligibility boils down to a few key areas.

- Age Brackets: The discount is often aimed at two main groups: new, younger drivers who are statistically higher-risk, and seniors over 55 looking to sharpen their skills and prove they’re still safe behind the wheel.

- Driving Record: This is a big one. Some insurers offer the discount as a reward for drivers who already have a clean record. Others see it as a tool for those who’ve had a recent ticket and need to remove points.

- State-Specific Rules: Where you live matters a lot. For example, some states have laws that mandate these discounts. A great example is New York’s Point and Insurance Reduction Program, which guarantees a 10% premium reduction for completing an approved course.

The single most important step you can take is to talk to your insurance provider directly. A quick call to your agent will clear up any confusion, confirm their specific rules, and make sure the course you’re considering is on their approved list.

It’s also helpful to know why you’re taking the course. Are you being proactive to get a discount, or are you reacting to a ticket? This can sometimes affect which savings you qualify for. For a closer look at how this works, especially for younger drivers, check out our guide on the insurance discount for drivers ed.

Finding an Approved Defensive Driving Course

So, you’re ready to lower your insurance premium? Great. But hold on—you can’t just sign up for any old driving course you find on the internet.

To get that coveted discount, you have to enroll in a program that’s officially recognized by both your insurance company and your state’s DMV. Think of it like a prescription: you can’t just grab any bottle off the shelf; you need the one specifically prescribed to you.

Taking an unapproved course is a surefire way to waste your time and money. Before you click “enroll” anywhere, you need to do a little homework to make sure the program is on the official list.

Online vs. In-Person Classes

You’ve got two main paths to choose from: taking the course online or heading to a physical classroom. Each has its own vibe, and the right choice really just boils down to your learning style and how packed your calendar is.

- Online Courses: These are all about flexibility. You can log in and work through the material whenever you have a spare moment—on your lunch break, after the kids are in bed, you name it. It’s perfect for juggling a busy schedule. If you want to see how one is structured, you can explore a fully approved online traffic school to get a feel for the format.

- In-Person Classes: If you’re someone who learns best by asking questions and interacting with people, a traditional classroom might be your speed. You get direct access to an instructor and can benefit from group discussions.

The format doesn’t matter nearly as much as the accreditation. Whether you’re clicking through modules at home or sitting in a classroom, the program must be approved by your state’s DMV and accepted by your insurance carrier.

How do you make sure you’re choosing a legit course? The easiest way is to start with a quick call to your insurance agent. They can often give you a list of providers they already work with.

Alternatively, you can head straight to your state’s DMV website, which usually has a searchable database of all certified schools. This simple check is your guarantee that the certificate you earn will actually be worth something, making the whole process hassle-free.

Is a Defensive Driving Course a Smart Investment?

So, you’re wondering if a defensive driving course is actually worth the money. The short answer is: it often is, but it pays to do the math first.

Think of it this way: you’re making a small, one-time investment to unlock savings for years to come. Most state-approved courses in Florida will only set you back between $25 and $100. That’s your upfront cost.

Now for the payoff. The discount you earn typically lasts for three full years. Let’s say your annual car insurance premium is $1,800. A 10% discount knocks off $180 every single year. Over those three years, you’ve pocketed $540 – all from that initial small investment. Not a bad return.

When It Might Not Make Sense

Of course, it’s not a slam dunk for every single driver. You have to look at your own policy to see if the numbers add up.

- You Already Have a Low Premium: If you’re paying very little for insurance, a percentage-based discount might only save you a few bucks a year, barely covering the course fee.

- You’re “Maxed Out” on Discounts: Insurance companies often put a cap on how many discounts you can stack. If you’ve already got a bunch, adding this one might not be an option.

The bottom line is to weigh the course fee against the savings you’ll see over the next three years. If the savings are much bigger than the cost, it’s a clear win that also comes with the bonus of making you a safer driver.

Before you sign up for anything, make a quick call to your insurance agent. Ask them directly what the discount percentage is and if you have any discount caps on your policy. This five-minute conversation will tell you exactly what you stand to save and ensure it’s the right move for your wallet.

Got Questions? Let’s Talk Insurance Discounts

Alright, even when you know the benefits, some practical questions always pop up. Let’s tackle the common ones we hear from drivers who are thinking about using a defensive driving course to save some cash.

How Long Will My Insurance Discount Last?

Great question. The discount isn’t a “one-and-done” permanent thing, but it does stick around for a while.

Typically, you’ll see that lower rate on your policy for a full three years. After that, the discount will expire, but the good news is you can usually just retake the course to keep the savings going. It’s always a smart move to double-check the exact timeline with your insurance agent, just to be sure.

Can I Use the Same Course to Get Rid of Points and Get a Discount?

Absolutely. This is one of the best parts about the system in states like Florida. A single, state-approved course can pull double duty.

You can take it to clear points off your driving record for a ticket, and at the same time, use that same completion certificate to qualify for the insurance discount. It’s a win-win.

Does Every Insurance Company Offer This Discount?

This is a big one. While most major insurance companies are on board with this, it’s not a 100% guarantee across the industry.

The availability of the discount and the exact percentage you’ll save can vary from one provider to another. Before you sign up for a course, a quick call to your insurance company is the best way to confirm they offer the discount and find out exactly how much you stand to save.