When your insurance company talks about “points,” what do they really mean? It’s not just jargon—it’s their internal scoring system for gauging how risky you are to insure.

Think of it as a financial report card for your driving. Every moving violation acts like a bad grade, and the more points you rack up, the more you can expect to pay for your policy.

What’s the Deal with Insurance Points, Anyway?

This is where a lot of drivers get tripped up. The points your insurance company assigns are completely separate from the demerit points issued by your state’s DMV or province’s MTO. They might be triggered by the same event, like a speeding ticket, but they serve two totally different purposes.

DMV points are all about your legal right to drive—get too many, and you could face a license suspension. Insurance points, on the other hand, are all about money. They directly influence how much you pay for your car insurance.

It helps to imagine you have two different records. One is with the government, and the other is with your insurer. A traffic ticket puts a black mark on both, but each one weighs that mark differently. What’s considered a minor offense by the DMV might be a major red flag for your insurance provider. You can dig deeper into what qualifies as a moving violation to see how this process kicks off.

The Real Difference Between DMV and Insurer Points

So, why the two systems? It all comes down to their goals.

The DMV’s point system is a public safety tool. It’s designed to penalize dangerous driving and, if necessary, remove unsafe drivers from the road. Insurance points are built on a foundation of financial risk. They’re a predictive tool your insurer uses to estimate the odds you’ll file a claim.

An insurance company’s point system is a risk-assessment tool. It translates your on-road actions into a score that predicts future costs, allowing the insurer to adjust your premium accordingly. More points signal a higher risk, leading to a higher price for coverage.

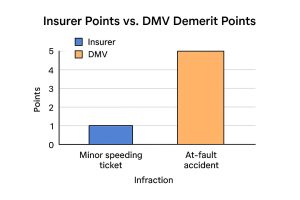

Since insurers are laser-focused on potential payouts, they assign points based on what types of incidents lead to the most expensive claims. An at-fault accident, for instance, might only add a couple of demerit points to your license but could slap five or more points onto your insurance record.

To make this crystal clear, let’s compare the two point systems side-by-side.

DMV Demerit Points vs Insurance Surcharge Points

| Attribute | DMV/MTO Demerit Points | Insurance Surcharge Points |

|---|---|---|

| Purpose | To enforce traffic laws and promote public road safety. | To assess financial risk and calculate insurance premiums. |

| Issuer | State or provincial government (e.g., DMV, MTO). | Your private insurance company. |

| Consequence | Can lead to fines, license suspension, or revocation. | Directly increases your insurance rates (premium surcharge). |

| Calculation | Standardized, publicly available point values for specific violations. | Proprietary system; varies significantly between insurers. |

| Key Focus | Severity of the moving violation itself. | The statistical likelihood that a violation will lead to a costly claim. |

| Example | A minor speeding ticket might be 2-3 demerit points. | A minor speeding ticket could be 1 insurance point. |

| Example | An at-fault accident might be 0-4 demerit points (depending on the citation). | An at-fault accident is often 3-5 or more insurance points. |

As you can see, the systems operate in parallel but have very different impacts.

This infographic really drives home how differently a minor speeding ticket and an at-fault accident are treated by each system.

The key takeaway is that insurers penalize at-fault accidents far more aggressively than the DMV does. This reflects the simple reality that the potential cost of an accident claim dwarfs the cost of a speeding fine. Grasping this distinction is the first and most crucial step to taking control of your insurance rates.

How Common Violations Impact Your Insurance Score

Not all traffic tickets are created equal, at least not in the eyes of your insurance company. A minor infraction might feel like a small bump in the road, but a serious one can send a financial shockwave through your budget. Insurers look at violations through a simple lens: how likely is this behavior to lead to a big, expensive claim?

This is why your insurance company’s reaction can feel so different from the penalty you get in court. The court’s job is to enforce the law; your insurer’s job is to predict future risk. A single mistake behind the wheel can easily translate into a higher bill that follows you for years.

Minor Violations: The Small Hits That Add Up

Think of minor violations as the entry-level offenses in the world of insurance points. These are things that don’t scream “reckless,” but they do suggest you weren’t paying full attention.

Common examples include:

- Minor speeding tickets: Usually for going 1-15 mph over the speed limit.

- Failure to signal: Forgetting to use your turn signal when changing lanes.

- Improper turns: Making a U-turn where you shouldn’t or turning from the wrong lane.

- Seat belt violations: Getting caught without buckling up.

These typically tack on just one or two insurance points. A single point might only nudge your premium up slightly, but a few of these tickets in a short time frame starts to paint a picture of a careless driver, leading to a much steeper rate hike. To see how this works in practice, check out our detailed guide on speeding ticket points in Florida.

Moderate Violations: The Clear Red Flags

Moving up the ladder, moderate violations are actions that show a more significant disregard for the rules of the road. To an insurer, these are clear red flags because they dramatically increase the odds of an accident.

This category often covers things like excessive speeding (driving more than 25 mph over the limit), blowing through a red light or stop sign, or causing an at-fault accident with property damage. For these, an insurer might assign three to four points. A 4-point violation is no small matter—it can easily cause your premiums to jump by 30% or more.

Major Violations: The Financial Knockouts

And then there are the major violations. These are the most serious offenses you can commit on the road, and they come with the heaviest penalties, both legally and financially. From an insurer’s perspective, these actions make a major claim feel almost inevitable.

A major violation like a DUI or causing an at-fault accident that injures someone can result in five or more insurance points. The financial fallout is often severe, potentially doubling your insurance premium or even leading to your insurer dropping you altogether.

Below is a table that breaks down some common violations and what they can mean for your insurance points and wallet.

Common Traffic Violations and Their Typical Insurance Point Impact

| Violation Type | Typical Insurance Points | Estimated Premium Increase |

|---|---|---|

| Minor Speeding (1-15 mph over) | 1-2 | 10-20% |

| Failure to Yield or Stop | 2-3 | 20-30% |

| At-Fault Accident (property damage) | 3-4 | 30-50% |

| Reckless Driving | 4-6 | 50-80% |

| DUI/DWI | 6+ | 80-150% or more |

| At-Fault Accident (bodily injury) | 6+ | 100% or more |

This table is just an estimate, as the exact impact varies by state and insurer. However, it clearly shows how your actions behind the wheel are directly tied to the rates you pay.

Ultimately, understanding this tiered system is key. Every decision you make on the road has a real, measurable financial consequence, connecting your driving habits directly to the size of your insurance bill.

The True Cost of Points on Your Premiums

It’s easy to look at a 30% or 40% premium hike and just see a number on a page. But when you start translating those percentages into actual dollars coming out of your bank account month after month, the reality hits hard. The real cost of points on insurance isn’t a one-and-done penalty. It’s a slow, steady drain on your finances that can cost you thousands over time.

This isn’t just about the first bill you get after a ticket or an accident. Insurance points stick to your record for years—typically three to five. Every time your policy renews, those points are still there, pushing your rate up. What might feel like a small bump at first can quickly snowball into a major financial headache.

A Real-World Example of How Costs Add Up

Let’s put some real numbers to this. Imagine a driver, we’ll call her Alex, who has a perfect record and pays a reasonable $1,500 a year for her car insurance.

Then, she has an at-fault accident. It wasn’t a huge one, but her insurance company assigns four points to her record. They now see her as a higher risk, so they slap her with a 40% surcharge.

Here’s how that single mistake chips away at her budget over the next three years:

- Year 1: Alex’s premium jumps from $1,500 to $2,100. That’s an extra $600 out of her pocket.

- Year 2: The points are still there, so her premium stays at $2,100. Another $600 gone.

- Year 3: Same story. She pays another $2,100, which is the final $600 surcharge.

By the time the points finally drop off her record, Alex has paid an extra $1,800. And that’s a conservative estimate—it doesn’t even factor in regular rate increases that might have happened anyway.

The cumulative effect is what really hurts. A single mistake doesn’t just cost you once; it costs you every single month for years, turning a minor violation into a major, long-term expense.

The Hidden Financial Penalties

The damage doesn’t stop with the direct rate hike. There are other financial hits that most people don’t think about until they’re already paying for them. These hidden costs can trap you in a cycle of high rates with few ways out.

For one, you can kiss your “good driver” status goodbye. Insurers reserve their best rates and discounts for drivers with clean records. Even one or two violations can kick you out of that preferred group, costing you access to big savings like “Claims-Free” or “Good Driver” discounts for years.

On top of that, having points on your record makes it incredibly difficult to shop for a better deal. When you ask a new company for a quote, they pull your driving history. Instead of offering you a competitive rate to earn your business, they’ll likely see the points and quote you a sky-high premium, leaving you stuck with your current expensive policy.

Protecting Your Wallet and Your Record

Seeing how these costs pile up really drives home the value of a clean driving record. The best move is always prevention, of course. But if you do get points, you need to act fast. Knowing your options is the first step to controlling the damage. If you’re looking for some practical strategies, our guide on how to lower insurance premiums is a great place to start. Keeping your record clean isn’t just about being a safe driver—it’s one of the smartest financial moves you can make.

When you get a ticket or have an accident, the first question on your mind is usually, “How long is this going to cost me?” The financial hit from points on insurance isn’t a one-time thing; it’s an extra charge that can follow you around for years. Knowing that timeline is the first step toward managing your budget and getting your rates back down.

The good news? Those points won’t haunt your premiums forever. But the bad news is they don’t vanish as soon as you pay the ticket. It’s a common misconception that paying a fine instantly clears your name with your insurer. In reality, you’re just starting the clock.

The Three-Year Rule of Thumb

For most common traffic violations, you can expect insurance points to inflate your premiums for about three years. But here’s the detail that catches a lot of people by surprise: that three-year countdown almost always starts on the conviction date, not the day you were pulled over.

This is a critical distinction. Let’s say you decide to fight a ticket in court. If your court date is months after the actual incident, that three-year surcharge window doesn’t begin until the day you’re found guilty.

Here’s a simple breakdown of how it works:

- The Violation: You’re ticketed for speeding on January 15th.

- The Conviction: You either pay the fine (which is an admission of guilt) or are convicted in court on March 1st. This is now your conviction date.

- The Rate Hike: Your insurance company adds the points at your next policy renewal, and you see your premium go up.

- The Duration: Those points will continue to impact your rates for the next three years, all the way until March of year three.

The clock on higher insurance rates doesn’t start when you see flashing lights in your mirror. It starts ticking on the day you are officially convicted of the violation.

When Can You Expect Financial Relief?

As long as you keep your driving record clean during this three-year period, the points should “fall off” your insurance record after the third anniversary of the conviction date. When your policy renews after that date, your rates should come back down, provided no other rating factors have changed.

It’s worth remembering that this timeline can vary a bit from one insurance provider to another. Some companies might look back further, especially for serious offenses like a DUI, but three years is the industry standard for most tickets. For a deeper dive into your specific situation, our guide on how long points stay on your driving record breaks it down even further.

The Bigger Economic Picture

While your personal driving habits are what matter most for your premium, it helps to understand the larger forces at play. The global insurance market is enormous and always in flux. In 2024, for example, the industry’s total premium income soared to EUR 7.0 trillion—an 8.6% jump from the previous year. You can read more about the resilient global insurance industry’s growth to get the full scope.

Numbers that big show just how much is at stake, which is why insurers rely so heavily on data—like driver points—to calculate risk for every single person they cover.

Proactive Steps to Reduce Points and Lower Premiums

Getting that notice in the mail—the one saying your insurance premium is going up because of points—is a gut punch. It’s easy to feel like you’re stuck, but that’s just not true. You have several powerful and practical ways to take back control, soften the blow of existing points on insurance, and get your rates moving back down.

Think of it as financial first aid for your driving record. You can’t just wipe a violation off the books, but you can absolutely manage the fallout. By being proactive, you can limit the damage, shorten the time you’re paying a penalty, and show your insurance company you’re a responsible driver who takes safety seriously.

Enroll in a State-Approved Defensive Driving Course

One of the single best tools you have is a state-approved defensive driving course, sometimes called a Basic Driver Improvement (BDI) course. This is so much more than just watching a few videos. It’s a strategic move that delivers a one-two punch against high premiums and points. In many states, finishing a certified course gives you some very real, tangible benefits that directly help your record and your wallet.

For drivers in Florida, for example, a course from a provider like BDISchool is built specifically to solve this problem. These programs are designed from the ground up to meet state rules for point reduction and even help with traffic fines.

Here’s how it works to your advantage:

- Point Reduction or Removal: Finishing the course often gets demerit points removed from your official DMV record for a specific ticket. Even though insurance points are separate, insurers are always looking at your DMV record. A cleaner slate makes you look like a much less risky customer.

- Direct Insurance Discounts: Many insurance companies will give you a straight-up discount on your premium just for voluntarily completing a defensive driving course. This discount can last for several years, often paying for the course many times over.

The real magic of a BDI course is that it solves two problems at once. You’re tackling the immediate issue of a ticket and its points while also locking in a guaranteed discount that actively lowers your insurance bill.

And the best part? It’s incredibly convenient. Modern online courses let you work at your own pace, so you can fit the lessons in whenever you have time, without messing up your work or family schedule. This flexibility makes it a smart and effective strategy for almost any driver who wants to turn things around.

Know When to Contest a Ticket

Sometimes, the best defense is a good offense. While it isn’t always the right call, there are times when fighting a ticket in court makes perfect sense, both legally and financially. If you have a solid driving history and genuinely believe the ticket was a mistake or there were special circumstances, it might be worth challenging it.

Before you decide to head to court, think about these things:

- Strength of Your Case: Do you have any proof? Dashcam footage or a witness who can back up your story can make a huge difference.

- Potential Costs: Add it all up. Consider the potential fine, court fees, and maybe even a lawyer’s fee, and weigh that against the long-term pain of a multi-year insurance hike.

- Your Driving History: A judge is often more willing to listen to a driver who has an otherwise spotless record.

If you win and are found not guilty, no conviction goes on your record. That means no demerit points from the DMV and no insurance points from your provider. This is the best-case scenario, as it completely stops that three-to-five-year premium surcharge before it ever starts.

Leverage Accident Forgiveness Programs

Many insurers offer accident forgiveness either as an optional add-on you can buy or as a perk for being a loyal, safe driver for years. This feature can be a true financial lifesaver. It’s basically a “get out of jail free” card for your first at-fault accident.

If you have this coverage and cause an accident, your insurer promises not to raise your rates. This stops them from adding the three to five insurance points that usually come with an at-fault crash, saving you from a surcharge that could easily cost thousands of dollars over the next few years. Pull out your policy documents or call your agent to see if you already have this protection—or if you can add it for some future peace of mind.

Let Time and Good Behavior Be Your Ally

Finally, one of the most reliable strategies is also the simplest: just drive safely and let the calendar do the work. Insurance points don’t last forever. As we’ve covered, they typically hang around and affect your premiums for about three years from your conviction date.

By keeping your record clean during this time, you make sure no new points get added to the pile. Every year you drive without an incident is another year closer to the day those old points expire and vanish from your record. This patient approach, combined with the other active strategies, gives you a complete game plan for earning back your good-driver status and getting the lower insurance rates you deserve.

Maintaining a Clean Record for Long-Term Savings

The best way to deal with points on insurance is to avoid getting them altogether. While courses can help with damage control after a ticket, the real secret is making safe driving an everyday habit. This isn’t just about steering clear of fines; it’s the smartest long-term strategy for locking in low insurance premiums.

Think of your driving record like a financial investment. Every year you drive without an incident, you’re building trust with insurance companies. You’re proving you’re a low-risk driver who deserves their best rates. This means shifting your mindset from just reacting to tickets to actively preventing them with smart, consistent habits.

Adopting Proactive Driving Habits

Building a clean record starts with solid defensive driving skills. It’s all about anticipating what other drivers might do, leaving plenty of room between you and the car ahead, and staying fully aware of your surroundings.

Beyond that, you have to get rid of distractions. Put the phone away. Set your navigation before you put the car in drive. The fewer things competing for your attention, the less likely you are to make a simple, but expensive, mistake.

The safest driver is the one who assumes others will make mistakes. By staying alert and creating a buffer of space and time, you protect yourself from both physical harm and the financial sting of insurance points.

Leveraging Technology for Better Rates

These days, insurance companies are using technology to directly reward safe drivers. These programs, often called telematics or usage-based insurance, track your actual driving habits using a small device in your car or an app on your phone.

They typically monitor a few key things:

- Hard braking and quick acceleration: Smooth, predictable driving is a good sign.

- Time of day: Driving at 2 AM is riskier than driving at 2 PM, and your rate can reflect that.

- Mileage: The less you drive, the lower your chances of being in an accident.

By proving you’re a safe driver with real data, you can earn some pretty significant discounts. It’s a direct way to turn your good habits into immediate savings.

It’s also helpful to understand the bigger picture. The insurance industry is constantly shifting based on economic trends and risk assessments. While some markets might be more favorable for buyers, others might see insurers holding firm on pricing. For instance, while some regions saw good conditions in early 2025, North American insurers kept rates moderately high due to various challenges. You can see more details in this global insurance market overview on aon.com.

This just goes to show why your personal driving record is your most powerful tool. No matter what the market is doing, a clean record always puts you in the best position to get the lowest possible rate.

Got Questions About Insurance Points? We’ve Got Answers.

Even after you get the hang of how insurance points work, some specific situations can still be a little confusing. It’s totally normal to wonder how things like out-of-state tickets or a pesky parking fine play out in the real world. Let’s clear up some of the most common questions we hear from drivers every day.

Think of this as your go-to guide for those nagging “what if” scenarios. We’ll tackle the details that really matter so you can feel confident about what’s on your record.

Do Out-of-State Tickets Mess With My Insurance?

The short answer? Yes, you can pretty much count on it. Most states have agreements to share driver information, like the Driver License Compact (DLC). So, when you get a ticket in another member state, your home DMV gets a notification, and that violation will almost certainly pop up on your driving record.

Once it’s on your official record, your insurance company sees it. From their perspective, it’s just like getting a ticket right in your own neighborhood, and they’ll likely assign points on insurance accordingly. Never assume an out-of-state ticket is a freebie—it has a habit of following you home.

Will a Parking Ticket Add Points to My Insurance?

Thankfully, no. Insurance points are reserved for moving violations, which are things you do while the car is actually in motion that signal risky behavior. A simple parking ticket is what’s called a non-moving violation.

While you definitely want to pay that parking fine to avoid bigger problems (like finding a boot on your car), you don’t need to stress about it bumping up your insurance rates. Insurers care about actions that increase your odds of a crash, and where you park doesn’t really fit that description.

Here’s the key distinction: Insurance points are all about on-the-road risk. Non-moving violations like parking tickets or even an expired registration sticker don’t reflect your driving habits, so they typically don’t lead to points.

How Long Will an At-Fault Accident Haunt My Rates?

This is one of the big ones. An at-fault accident can add serious points to your record, and the financial sting can last for a while. In most cases, you can expect an at-fault accident to inflate your insurance premiums for three to five years.

During that time, you’ll likely lose any “good driver” or “claims-free” discounts you had and get hit with a hefty surcharge on top of that. The best thing you can do is keep your record spotless moving forward. That’s the only way to ensure those points eventually drop off and your rates can get back to normal.

If you’re dealing with a ticket in Florida, you don’t have to just accept higher insurance costs. BDISchool offers a state-approved online Basic Driver Improvement course designed to keep points off your driving record. Completing it might even earn you a discount on your insurance. Take back control of your driving record by visiting https://bdischool.com today.